With a new administration, Argentina stands at a potential turning point. By implementing aggressive fiscal and monetary reforms, President Milei’s government aims to stabilise the economy and reduce inflation. The likely success of these measures in sparking economic recovery is an open question.

With one of the world’s highest inflation rates and after more than a decade of economic stagnation and rising poverty, Argentina once again finds itself teetering on the brink of economic collapse. The urgent need for a plan to stabilise the economy has entrusted the newly elected President Javier Milei with a clear mandate: eradicate inflation and reignite economic growth. As the nation watches with a mixture of exhaustion and bated breath, the world also turns its gaze to Argentina, wondering whether Milei’s strategies will be the long-awaited remedy for the country’s struggles.

The deep-rooted cause of Argentina’s economic distress and chronic inflation is persistent public overspending financed by money creation. This understanding lies at the core of Milei’s policy agenda. While the plans signal a move in the right direction, there are no silver bullets. Achieving low and stable inflation involves difficult trade-offs; implementation is challenging; and reforms often take time to bear fruit.

What are the longstanding causes of Argentina’s economic struggles?

Persistent fiscal deficits and chronic inflation are longstanding issues in Argentina. The inflation rate averaged 190% between 1944 and 2023, and the government defaulted on its sovereign debt nine times (of which three occurred during the past two decades). More recently, the size of the consolidated government increased by almost 15 percentage points of GDP: from 23.2% in 2003 to 37.8% of GDP in 2022. Argentina has continuously run fiscal deficits since 2009, with the shortfall reaching 4.4% of GDP in 2023.

Governments do not always need to run fiscal surpluses, especially in a growing economy with access to international capital markets. But Argentina is a long way off being in this situation. Over the last decade, the country has witnessed a 10.4% drop in per capita income, and its history of sovereign defaults and restructurings has led to prohibitively high interest rates in international credit markets. As a consequence, the strategy has been an increasing reliance on the inflation tax as the means to finance the fiscal gaps.

The inevitable outcome has been a decline in the value of the Argentine peso and significant pressures on the official exchange rate. To prevent currency depreciation, the policy response was to resort to price and capital controls (commonly known as ‘cepo’), several multiple exchange rates, negative real interest rates, quantitative import restrictions and export taxes.

But these policies have served as mere stopgaps, as they have compounded relative price distortions, widened the gap between the official and informal market exchange rates, and led to deterioration in the central bank’s balance sheet.

Exchange rate manipulation artificially distorts trade flows, prompting importers to advance their imports, and exporters to mis-invoice their exports in anticipation of future devaluations. This has led the central bank to deplete its international reserves and increase interest-bearing liabilities, which are notes and bonds issued to absorb the excess liquidity resulting from money creation. For example, before Milei took office, the central bank held interest-bearing liabilities worth 11.3% of GDP and negative net international reserves of more than $11 billion.

These distortions have taken a hefty toll on the real economy. Investment has only grown at 1.1% between 2011 and 2023, and World Bank data show that credit to the private sector by banks was only 10.7% in 2022 – compared with an average of 47.4% in Latin America and the Caribbean as a whole. Exports per capita have also declined by 27.3% between 2011 and 2021 (Atlas of Economic Complexity).

But the Argentine economy has the potential to prosper. While many countries struggle to diversify and integrate into the global economy, Argentina has many avenues for sustained growth, including high-tech activities in agriculture, oil and gas, lithium, information technologies and software development (to name just a few).

Yet the recurring economic instability has undermined the high potential of many of these opportunities. So, creating a financially viable state would increase national savings and capital flows, reduce interest rates and foreign exchange rate risk, and allow for an environment conducive to investment and growth. The industries are there, but the wider economic conditions act as a drag on progress.

While Milei appears poised to address the root cause of Argentina’s economic problems with resolute actions, the road ahead is still fraught with challenges.

A new strategy: Milei’s fiscal and monetary policy approaches

Since Milei assumed office on 10 December 2023, his administration has been implementing a dual approach to stabilising Argentina’s economy. The first component is fiscal reform. Acknowledging chronic overspending as a key driver of inflation, the government has focused on eradicating the large fiscal deficit.

Previous programmes where fiscal adjustment was either absent or short-lived got quickly off track, such as the Argentine 1978 ‘Tablita’, the 1985 Austral Plan, and the recent attempt of former President Macri’s administration between 2016 and 2019 (Calvo and Vegh, 1999; Sturzenegger, 2019).

The second component is the monetary approach, aimed at restoring the central bank’s balance sheet by reducing the large peso-denominated liabilities and increasing foreign assets.

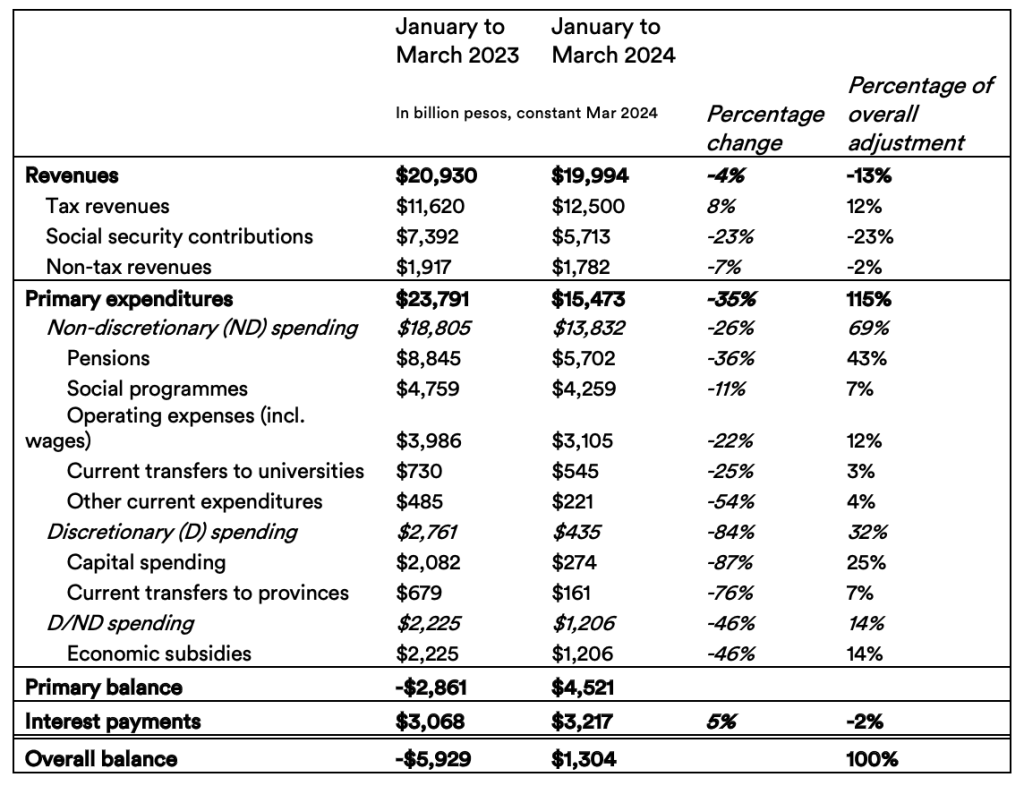

Fiscally, the government has set an ambitious goal to cut the deficit by five percentage points of GDP in 2024. Progress is evident, with a fiscal surplus recorded in the first quarter of the year (see Table 1). Spending cuts have been deep and across the board, slashing real primary expenditures by 35% compared with last year.

On the one hand, non-discretionary spending is being adjusted below the inflation rate. For example, pensions decreased by 36% year-over-year and contributed the lion’s share of the overall fiscal adjustment, amounting to 43% of the total. On the other hand, the cuts include a significant nominal reduction in discretionary spending. Capital spending and transfers to provinces contributed 32% of the overall fiscal adjustment. Economic subsidies, particularly for energy firms, have been reduced at the expense of accumulating arrears with utility companies.

On the revenue side, despite a 4% drop in total real revenues due to decreased social security contributions, tax revenues are up, fuelled by the ‘Impuesto País’. This tax on certain exchange rate operations – acting as a de facto import duty – currently makes up 9% of total revenues. Economists debate its classification, arguing that recognising it as an import tax could accelerate the removal of exchange rate controls.

Table 1: Fiscal accounts of the national public sector

On the monetary front, the central bank has focused on addressing the excess supply of pesos. Fiscal surpluses contributed to the elimination of all monetary financing to the government.

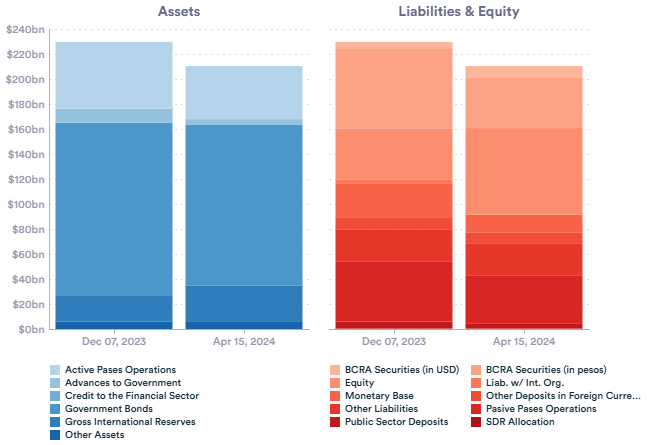

At the same time, the central bank holds a large amount of interest-bearing liabilities, which aim at absorbing part of the excess money created to finance fiscal deficits. While monetary financing does not bear interest to the central bank, it exerts pressure on the official exchange rate, therefore forcing the central bank to resort to these more expensive liabilities to mitigate its impact. Before Milei took office, the monetary base and net interest-bearing liabilities – that is, BCRA (Banco Central de la Republica Argentina) securities in pesos minus net pases operations – represented 37.7% of total assets.

The devaluation of the peso that occurred three days into Milei’s term of office significantly helped to reduce this large stock. To correct the overvalued exchange rate and bridge the significant gap with the informal exchange rate market, the central bank devalued the peso by around 50% – from 391 pesos to 833 pesos per US dollar – diminishing both the monetary base and interest-bearing liabilities on the balance sheet.

Since the devaluation, the central bank has rapidly reduced nominal interest rates, currently at an annual rate of 50%. As these rates are running below inflation, this approach has helped to reduce the real interest payments by the central bank and thus curtail the flow of new interest-bearing liabilities. Figure 1 shows the reduction of BCRA securities from $64.3 to $40.6 billion between 7 December 2023 and 15 April 2024.

On the assets side, the central bank is committed to turning net international reserves – gross reserves minus swap lines and deposits in foreign currency – into positive territory. While they are still negative, the central bank has been able to accumulate gross reserves, which reached $29.2 billion on 15 April 2024.

But these reserves remain insufficient to settle the substantial inherited debt owed to importers. In 2023, as the central bank could no longer afford to lose reserves, it stopped selling foreign currency to importers. To address this challenge, the central bank issued the BOPREAL, a series of bonds designed to pay importers over the coming months and years by leveraging the foreign assets that the central bank is committed to accumulate.

While the BOPREAL has allowed for a maturity lengthening of the liabilities at the central bank, it also implies an increase in dollar-denominated liabilities. Along with other securities called Lediv, the BOPREAL pushed dollar-denominated liabilities to $9 billion (or 4.3% of total assets). Although it has received less attention, it is noteworthy that the share of government bonds held by the central bank (mostly denominated in pesos) remains large, accounting for around 61% of total assets.

Finally, accumulating international reserves is crucial for any new monetary policy regime to be credible. To date, the central bank has introduced a ‘crawling peg’, a regime that depreciates the currency by 2% monthly and decided to maintain inherited capital controls. While many expected an early removal due to the distortions it generates, as explained above, keeping them allows the central bank to manage and reduce the money supply more effectively by controlling capital flows.

What future challenges does the government face?

Milei’s strategy so far has yielded several promising initial results. Sovereign spreads – a measure of the default risk on a country’s government bonds – have dropped significantly: by more than 700 basis points between 4 December 2023 and 22 April 2024. While still at high levels, monthly inflation fell sharply from 25% in December, after the initial devaluation, to 11% in March. The central bank has also been able to accumulate international reserves and stabilise the gap between the official and informal exchange rates at around 20%, containing market expectations of a significant devaluation moving forward.

But while these measures have steered these indicators in the right direction, they have also imposed a substantial economic and social cost. The stringent belt-tightening on both fiscal and monetary fronts has rapidly shifted expectations, yet it has simultaneously driven the economy into a deep recession.

This highlights the delicate trade-off between stabilising the economy and promoting growth. Economic activity fell by 3.3% year-over-year per month in December, January and February. Private estimates also suggest a decline in March. Relative price distortions have not yet been fully corrected. For example, the reduction in economic subsidies, leading to increased utility tariffs for the public, only began this April. Further effects may soon take hold.

The severe recession raises questions about when and how the country will return to a path of economic growth. Although a slow recovery of real wages and an improved 2023/24 agricultural harvest may provide short-term relief, the government must seek alternative fiscal strategies to mitigate the heavy toll on the private sector.

For example, reassessing the importance of the curtailed public investment is crucial. Protecting public investment during fiscal adjustments creates incentives for expanding private investment (Izquierdo et al, 2019). It can also neutralise the contractionary effects of fiscal adjustments, and even spur output growth over the medium term (Puig et al, 2021).

As it serves as a complementary factor of production, it is also associated with the productivity of the private sector and its ability to thrive and enhance economic growth. So, it is essential strategically to maintain certain areas of public investment or, alternatively, to promote private sector-led initiatives for public good provision.

On the external front, removing capital controls is crucial to unlock export-led growth in the medium to long term. The timing of the removal remains uncertain, as the controls play a crucial role in sustaining fiscal adjustment and cleaning up the central bank’s balance sheet.

Meanwhile, the clock is ticking given the race between inflation and the 2% monthly depreciation rate. Specifically, as inflation accelerates at a pace faster than the depreciation of the currency, there is a concern that the real currency appreciation will lead to deterioration in the trade balance, compromising the accumulation of international reserves and exerting pressure on the official exchange rate.

At the same time, given the deep reforms being undertaken, macroeconomic fundamentals are changing, making it difficult to determine the equilibrium value of the exchange rate. In any case, the current crawling peg regime lacks credibility as a long-term stabilisation mechanism.

A new monetary framework will need to emerge. Currently, all monetary options are on the table, including adopting a more flexible regime that adjusts interest rates to control inflation, a system where multiple currencies circulate and compete within the economy, and abandoning the local currency entirely in favour of the US dollar.

Lastly, the success of any new stabilisation plan hinges on a credible commitment to implement fiscal reforms effectively. Milei seems determined to go all the way. But the government needs to secure congressional approval, where it lacks a majority, as well as other political and judicial support to cement its fiscal reforms moving forward.

As we write this piece, extensive deliberations are underway in Congress, focused on analysing the multitude of laws that Milei is pushing. Economic policy planning is one thing: political and legal delivery is another.

It is the first time since the turn of the century that Argentina is purposefully addressing the deep-rooted cause of all its economic struggles. The government should be strategic so that the country can, once and for all, break free from its recurring challenges and finally unlock its economic potential. Plans are in place, but there is still much work to be done.